Introduction

Overview of Cryptocurrency in 2025

As we look ahead to 2025, cryptocurrency stands on the cusp of remarkable advancements. The landscape is projected to evolve significantly, with digital currencies becoming even more integrated into everyday transactions. Imagine making purchases or settling bills effortlessly using Bitcoin or Ether. With innovations in blockchain technology and shifting consumer attitudes, the acceptance of cryptocurrencies is bound to grow.

Significance of Predicting Cryptocurrency Trends

Why is predicting trends in cryptocurrency so critical? Here are a few reasons:

- Investment Opportunities: Understanding future movements can help investors make informed decisions.

- Regulatory Awareness: Being aware of potential regulations can impact investment strategies.

- Technological Adaptation: Recognizing which technologies will shape the future can lead to better utilization of digital currencies.

By recognizing and preparing for these shifts, individuals and businesses alike can navigate the evolving world of finance with confidence.

Evolution of Cryptocurrency

History and Milestones

The journey of cryptocurrency began with Bitcoin’s inception in 2009, igniting a financial revolution. Over the years, it has reached significant milestones:

- 2011: Emergence of alternative currencies like Litecoin.

- 2017: Bitcoin surge past $20,000, capturing global attention.

- 2020: Rise of DeFi, enhancing financial services like lending and trading.

These milestones not only reflect the growth of digital currency but also underscore its potential to disrupt traditional finance.

Regulatory Landscape in 2025

Fast forward to 2025, the regulatory landscape surrounding cryptocurrency is expected to mature significantly. Governments worldwide are set to implement comprehensive frameworks that could affect various facets of digital currencies. Key changes may include:

- Standardization of regulations: Countries working together to establish uniform rules.

- Taxation policies: Clear guidelines on how cryptocurrencies are taxed.

- Consumer protection laws: Enhanced measures to protect investors from fraud.

These developments will shape the future of digital currencies, reassuring investors and fostering greater adoption. Understanding these regulations will be crucial for anyone engaged in the cryptocurrency market as it evolves.

Evolution of Cryptocurrency

History and Milestones

The journey of cryptocurrency began with Bitcoin’s inception in 2009, igniting a financial revolution. Over the years, it has reached significant milestones that have reshaped public perception and engagement with digital currencies:

- 2011: Emergence of alternative currencies, like Litecoin and Ripple, which diversified the market.

- 2013: Introduction of smart contracts with Ethereum, expanding the potential applications of blockchain technology.

- 2017: Bitcoin’s price surged past $20,000, bringing cryptocurrencies into mainstream financial conversations.

- 2020: The rise of Decentralized Finance (DeFi) projects introduced innovative financial services, such as lending and automated trading.

These milestones not only reflect the growth of digital currency but also underscore its potential to disrupt traditional finance. Many early adopters recall the excitement and anxiety of watching Bitcoin’s rollercoaster ride—an experience that has paved the way for millions to consider the implications of digital money.

Regulatory Landscape in 2025

Fast forward to 2025, the regulatory landscape surrounding cryptocurrency is expected to mature significantly. Governments worldwide are set to implement comprehensive frameworks that could directly influence how cryptocurrencies operate. Key changes may include:

- Standardization of regulations: Countries working collaboratively to establish uniform rules for cryptocurrency operations, ensuring a more stable market.

- Taxation policies: Clear guidelines on how cryptocurrencies are taxed, which may encourage more individuals to participate in financial transactions using digital assets.

- Consumer protection laws: Enhanced measures to protect investors from fraud and scams, building confidence in the growing cryptocurrency market.

These developments aim to shape the future of digital currencies, reassuring investors and fostering greater adoption. As consumers increasingly explore the advantages of cryptocurrency, understanding these regulations will be crucial for anyone engaged in the cryptocurrency market as it continues to evolve, and those who hope to reap the benefits of its future innovations.

Technology Trends Shaping Cryptocurrency

Impact of Blockchain Innovations

Following the evolution of cryptocurrency, innovative advancements in blockchain technology are playing a crucial role in its expansion. From increasing transaction speeds to enhancing security protocols, these innovations are redefining the digital currency landscape. Some notable impacts include:

- Interoperability: Blockchains are increasingly able to communicate with one another, providing seamless transfers of assets across different platforms.

- Smart Contracts: Automated agreements enforceable on the blockchain are simplifying complex transactions, reducing the need for intermediaries.

- Layer 2 Solutions: Techniques like the Lightning Network are improving scalability and reducing fees, making peer-to-peer transactions more efficient and accessible.

These innovations not only enable a more robust infrastructure but also empower users with greater control over their assets.

Role of Decentralized Finance (DeFi)

As we transition further into the realm of cryptocurrency, Decentralized Finance (DeFi) emerges as a game-changer. This movement is reshaping how individuals interact with traditional financial systems. Imagine being able to lend or borrow without intermediaries, all facilitated through smart contracts—this is the essence of DeFi.

Key components driving DeFi’s growth include:

- Accessibility: DeFi platforms are open to anyone with an internet connection, breaking down barriers that traditional finance imposes.

- Yield Farming: Users can earn rewards for providing liquidity, creating imaginative ways for income generation that were previously unavailable.

- Non-Custodial Solutions: Users retain control of their private keys, enhancing security and empowering individuals in their financial decisions.

The DeFi ecosystem reflects the promise of a more inclusive financial environment, offering alternatives that can revolutionize individuals’ relationships with money. As these technology trends continue to evolve, they lay the groundwork for an exciting future for cryptocurrencies and their integration into daily life.

Market Predictions and Investment Strategies

Forecast for Cryptocurrency Market

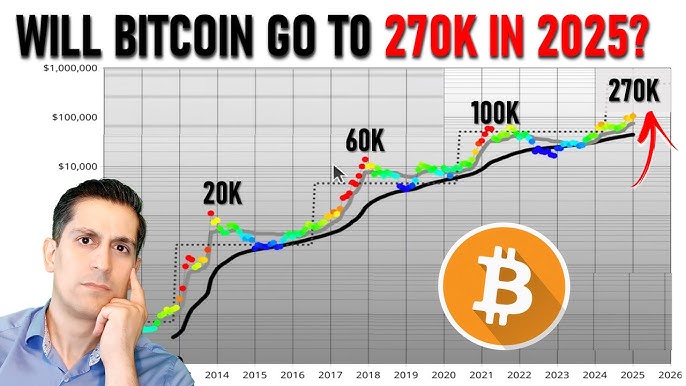

Building on the technological advancements we’ve explored, the future of the cryptocurrency market looks promising. Experts predict that by 2025, the total market capitalization could reach new heights due to increased adoption and a variety of new applications. Key forecast elements include:

- Increased Institutional Investment: More companies and funds are expected to allocate a portion of their portfolios to cryptocurrencies, viewing them as a hedge against inflation.

- Mainstream Adoption: With companies like PayPal and Tesla accepting digital currencies, everyday use cases are likely to grow exponentially.

- Emergence of New Coins: Innovations will drive the creation of new cryptocurrencies that cater to specific niches, further diversifying investment opportunities.

As a result, the excitement and interest around cryptocurrencies continue to gain momentum, making this an appealing time to consider investing.

Diversification Approaches for Investors

As the crypto landscape evolves, so too should investors’ strategies. Diversification remains a cornerstone of sound investment practices. Here are some ways to diversify within the cryptocurrency market:

- Invest in Multiple Coins: Rather than focusing solely on Bitcoin or Ethereum, consider exploring altcoins with strong fundamentals, like Cardano or Solana.

- Utilize DeFi Platforms: Engage in yield farming or liquidity pooling to leverage your assets while spreading risk across various DeFi ecosystems.

- Stay Informed about Trends: Continuously educate yourself on emerging projects and technological advancements to make informed decisions and identify potential growth areas.

In practice, effective diversification can cushion against volatility while positioning investors to capitalize on the ever-evolving cryptocurrency market. By strategically navigating their investments, enthusiasts can embrace the future of digital currency with confidence and adaptability.

Challenges and Risks Ahead

Security Concerns in Cryptocurrency

As the cryptocurrency landscape continues to grow, security remains a pressing concern for investors and users alike. Although blockchain technology is inherently secure, various vulnerabilities can expose individuals to risks. Here are some major security concerns to be aware of:

- Hacks and Scams: High-profile exchange hacks and scams have led to substantial financial losses. For instance, incidents like the Mt. Gox hack serve as cautionary tales for investors.

- Phishing Attacks: Cybercriminals often employ phishing tactics, tricking users into revealing their private keys or login credentials.

- Smart Contract Vulnerabilities: While DeFi offers innovative opportunities, poorly coded smart contracts can lead to exploits and irretrievable financial losses.

Understanding these risks is crucial for users to safeguard their investments and choose secure platforms wisely.

Legal and Compliance Challenges

In addition to security, the regulatory landscape poses significant legal challenges. Investors must navigate an evolving set of rules that vary widely across countries. Some key compliance challenges include:

- Regulatory Clarity: Many jurisdictions still lack comprehensive regulations, leading to uncertainty for businesses and investors operating in the space.

- Tax Implications: Differing taxation policies can create complications for users, especially those participating in trading or DeFi.

- Fraud Prevention: Governments worldwide are ramping up their efforts to combat money laundering and fraud linked to cryptocurrencies, necessitating compliance with stringent reporting requirements.

These legal hurdles can create friction in how cryptocurrencies are adopted and integrated into traditional financial systems. As investors, staying informed about these challenges is essential to navigate the cryptocurrency landscape effectively and minimize potential pitfalls.

Cryptocurrency Adoption in Different Sectors

Cryptocurrency in Banking and Finance

Following the discussion on challenges and risks, it’s exciting to see how cryptocurrencies are carving out a place in traditional banking and finance. Institutions are embracing digital currencies, understanding their potential to enhance efficiency and accessibility. Key developments include:

- Cross-Border Transfers: Many banks are exploring cryptocurrency for faster and cheaper international payments. For example, Ripple’s technology has gained traction for streamlining such transactions.

- Digital Wallets: Financial institutions are increasingly offering integrated cryptocurrency wallets, allowing customers to manage both fiat and digital currencies seamlessly.

- Lending and Borrowing Platforms: Traditional banks are exploring partnerships with DeFi platforms, making it easier for clients to access loans using cryptocurrency as collateral.

These shifts signal a growing acceptance of digital currencies in mainstream finance, creating exciting opportunities for consumers and businesses alike.

Use Cases in Healthcare and Real Estate

Beyond banking, the adoption of cryptocurrencies is making significant inroads into sectors like healthcare and real estate. Here’s how these industries are leveraging digital currencies:

- Healthcare Innovations:

- Patient Data Security: Blockchain technology can enhance the security and privacy of patient records. For instance, using decentralized ledgers, hospitals can ensure that only authorized personnel access sensitive information.

- Transparent Transactions: Cryptocurrencies can streamline payment processes between providers and patients, reducing administrative costs and improving efficiency.

- Real Estate Applications:

- Property Transactions: Blockchain enables smart contracts to automate and secure property transactions, allowing for faster and more transparent deals without the need for intermediaries.

- Tokenization of Assets: Real estate can be fractionally owned through tokenization, allowing more people to invest in properties and diversify their portfolios.

With the integration of cryptocurrencies in these sectors, the potential for innovative solutions is immense, offering practical applications that enhance efficiency and transparency while changing the way we interact with technology in our everyday lives.

Environmental Considerations and Sustainable Practices

Energy Consumption of Cryptocurrency Mining

As the cryptocurrency landscape continues to expand, environmental concerns, particularly surrounding energy consumption, have come to the forefront. The process of mining, especially for proof-of-work coins like Bitcoin, is often criticized for its significant energy use. Consider the following points:

- High Energy Demand: Mining operations require vast amounts of electricity, often sourced from fossil fuels, leading to large carbon footprints. For example, estimates suggest that Bitcoin mining consumes more energy than some countries.

- Heat Generation: The hardware involved in mining generates substantial heat, raising questions about sustainability and environmental impact, especially in regions prone to climate issues.

- Public Perception: Growing awareness of climate change has led to increased scrutiny of cryptocurrency’s environmental impact, which could influence regulatory decisions and consumer behavior.

As enthusiasts navigate these concerns, it’s essential to acknowledge the industry’s responses to encourage sustainable practices.

Sustainability Efforts in the Cryptocurrency Industry

In response to growing environmental concerns, the cryptocurrency industry is making strides toward more sustainable practices. Here are some notable initiatives:

- Switch to Renewable Energy: Many mining operations are transitioning to renewable energy sources like solar, wind, and hydro power. For instance, some Bitcoin miners are now powered largely by excess energy from renewable sources.

- Proof of Stake (PoS) Models: Alternatives to traditional mining, such as PoS, require significantly less energy. By validating transactions based on token ownership rather than computational power, PoS cryptocurrencies like Ethereum 2.0 are positioning themselves as more environmentally friendly.

- Carbon Offsetting: Several projects are implementing initiatives to offset their carbon footprints, investing in reforestation or clean energy projects to balance out emissions associated with mining activities.

These sustainability efforts illustrate that the cryptocurrency industry is aware of its environmental impact and is taking proactive steps to mitigate it. As both consumers and investors become more environmentally conscious, these innovations could play a pivotal role in shaping the future of digital currencies.

Future of Cryptocurrency Regulations

Global Regulatory Trends

As the environmental considerations in cryptocurrency evolve, so do regulatory trends aimed at providing clarity and security in this burgeoning market. Across the globe, different nations are starting to take action, reflecting varied approaches to cryptocurrency regulation:

- Comprehensive Frameworks: Some countries, such as the European Union, are working towards cohesive regulations that encompass various aspects of cryptocurrency, from taxation to consumer protection.

- Licensing Requirements: Increased regulatory scrutiny has led to more jurisdictions requiring businesses to obtain licenses to operate in the cryptocurrency space, ensuring compliance with local laws.

- Collaborative Efforts: International organizations are facilitating dialogue between countries to create and harmonize regulations. Efforts like the Financial Action Task Force (FATF) guidelines promote global standards in combating money laundering and terrorist financing in the crypto sector.

These trends highlight the move towards a regulated environment that balances innovation with consumer safety, shaping the landscape for future cryptocurrency engagement.

Impact of Government Policies on Cryptocurrency

In addition to global regulatory trends, specific government policies are significantly shaping the trajectory of cryptocurrencies. The choices made by policymakers can either foster growth or hinder adoption:

- Tax Policies: Clear taxation frameworks can encourage investment and participation while ambiguities may deter individuals and businesses from entering the market.

- Ban or Embrace: Countries like China have imposed outright bans on cryptocurrency transactions, while others, like El Salvador, have embraced Bitcoin as legal tender, demonstrating the polarizing viewpoints of governments.

- Incentives for Innovation: Some governments are providing grants or tax breaks to blockchain-based companies, fostering innovation in the space and attracting entrepreneurs.

Understanding the implications of these government policies is vital for anyone involved in the cryptocurrency market. As regulations continue to evolve, staying informed will help users navigate potential changes and leverage opportunities that arise within this dynamic environment.

Conclusion and Key Takeaways

Summary of Cryptocurrency Trends in 2025

As we look toward 2025, the cryptocurrency landscape is poised for transformative changes influenced by technology, regulation, and broader societal acceptance. Key trends include:

- Increased Institutional Adoption: Expect more organizations to allocate funds to cryptocurrencies, legitimizing their status in traditional finance.

- Evolving Regulations: A more defined regulatory environment will help reduce uncertainty and encourage greater participation.

- Sustainability Initiatives: The industry will increasingly focus on reducing its environmental impact through renewable energy sources and more energy-efficient consensus mechanisms.

These trends signify a maturing cryptocurrency ecosystem that will likely shape how we perceive and interact with digital currencies.

Key Considerations for Navigating the Future

For those looking to engage with cryptocurrency in the coming years, there are several key considerations to keep in mind:

- Stay Informed: Regularly follow updates on regulatory changes and technological advancements to make educated decisions.

- Diversify Investments: Don’t put all your eggs in one basket—consider spreading investments across various cryptos to mitigate risk.

- Embrace Security Practices: Be proactive in educating yourself about security measures to protect your assets from hacking or scams.

By keeping these considerations in focus and being adaptable, individuals can confidently navigate the future of cryptocurrency, positioning themselves for success in a rapidly evolving landscape. The potential for innovation and growth remains significant, inviting consumers and investors alike to engage responsibly in the digital currency realm.